Real Estate UpdateJuly 15, 2014 Budget 2014: A Game changer for REITs?Budget 2014-15 (“Budget”) has introduced tax incentives for the real estate investment trusts (“REITs”) regime, and also provided for relaxations in foreign direct investment (“FDI”) regime. With the tax incentives in place, the Securities and Exchange Board of India (“SEBI”) is likely to formally announce the REIT regulations that are currently in draft form. In this hotline, we discuss some of the key changes and its Budget 2014 impact on the real estate sector. For a detailed analysis of the impact of Budget 2014-15 on other aspects as well, please refer to our hotline “India Budget 2014: New Beginnings and New Direction”. CHANGES IN RELATION TO REITS1. Background As a background, the Securities and Exchange Board of India (“SEBI”) had released the draft regulations on REITs (“Draft Regulations”) for comments on October 10, 2013. The Draft Regulations as released are available here. Though the Draft Regulations were received positively, it was imperative that attendant tax and regulatory incentives were also announced. Now, with the tax incentives announced and effective from October 1, 2014, it seems almost certain that the SEBI will put in place an operating framework for REITs by October 2014. Please refer to our article titled “REIT Regime In India: Draft REIT Regulations Introduced” for a detailed analysis of, and our suggestions on, the Draft Regulations. 2. Structure of REIT Before we move on the tax incentives proposed in the Budget, we set out below a quick snapshot of the REIT structure as contemplated under the Draft Regulations. REITs in India are required to be set up as private trusts under the purview of the Indian Trusts Act, 1882. (i) Parties: The parties in the REIT include the sponsor, the manager, the trustee, the principal valuer and the investors / unit holders. Sponsor sets up the REIT, which is managed by the manager. The trustee holds the property in its name on behalf of the investors. The roles, responsibilities, minimum eligibility criteria and qualification requirements for each of the abovementioned parties are detailed in the Draft Regulations. Sponsors are required to hold a minimum of 15% (25% for the first 3 years) of the total outstanding units of the REIT at all times to demonstrate skin-in-the-game. (ii) Use of SPV: REITs may hold assets directly or through an SPV. All entities in which REITs control majority interest qualify as an SPV for the purpose of the Draft Regulations. (iii) Investment and Listing: Units of a REIT are compulsorily required to be listed on a recognized stock exchange. (iv) Potential income streams: REITs are principally expected to invest in completed assets. Income would consist of rental income, interest income or capital gains arising from sale of real assets / shares of SPV. (v) Distribution: 90% of net distributable income after tax of the REIT is required to be distributed to unit holders within 15 days of declaration. The illustration below gives the typical REIT structure:

3. Proposed tax regime under the Budget The Finance Bill, 2014 (“Bill”) proposes to amend the Income Tax Act (“ITA”) to provide for the income tax treatment of REITs. These provisions have been incorporated depending on the stream of income that the REIT is earning and distributing: (i) Units of REIT akin to listed shares The Bill proposes that when a unit holder disposes off units of a REIT, long term capital gains (“LTCG”) (units held for more than 36 months) would be exempt from tax and short term capital gains (“STCG”) would be taxed at 15% since units would be treated as listed securities under the ITA. In addition to the above, the Bill has also proposed that securities transaction tax is to be payable on transfer of units of a REIT. Analysis

(ii) Tax treatment of the sponsor - The Bill proposes to make the transfer of shares of the SPV into a REIT in exchange for issue of units of the REIT to the transferor (or the sponsor) exempt from capital gains tax under the ITA. However, although the units of a REIT would be listed on a recognized stock exchange, specific amendments are proposed to exclude units of REITs from the exemption of tax on LTCG / STCG if sold by the sponsor; and the cost of acquisition of the shares of the SPV by the sponsor shall be deemed to be the cost of acquisition of the units of the REIT in his hands. Analysis

(iii) Income in the nature of interest - The Bill provides for a pass through treatment in respect of any interest income that is received by the REIT from an SPV. This will result in the REIT not being subject to any tax in respect of such interest income, whereas the investors will be subject to tax on the same. However, there would be a levy of withholding tax that would be imposed on distribution by the REIT to its unit holder. This withholding tax would be at the rate of 10% if paid to resident unit holders and 5% if paid to non-resident unit holders.1 In case of non-resident unit holders, the 5% tax would be the final tax payable by the non-resident, while in case of residents, they will be subject to tax as per the tax rate applicable to them. Analysis

(iv) Income in the nature of dividend - Where dividends are distributed by the SPV to the REIT, the existing provision dealing with Dividend Distribution Tax (“DDT”) under Section 115-O of the ITA would apply and the SPV would face a 15% tax on distribution with no further liability on the REIT as a shareholder. Further, the Bill proposes that any income distributed by the REIT to its unit holder that is not in the nature of interest or capital gains is exempt from income tax. Therefore, distributions of dividends received from the SPV by the REIT to the unit holders would be exempt from tax in India. Analysis

(v) Income in the nature of business profits/lease rentals/management fee - Chapter XII-FA is proposed to be added to the ITA by which Section 115UA is to be included for dealing with the taxation of income earned by a REIT that is not in the nature of capital gains, interest income or dividend. All such income is proposed to be taxed in the hands of the REIT at the maximum marginal rate i.e. 30%. Such income, while distributed by the REIT to the unit holders would be exempt in the hands of the unit holders. Analysis

(vi) Income in the nature of capital gains - Where the REIT earns income by way of capital gains by sale of shares of the SPV, the REIT would be taxed as per regular rates for capital gains i.e. 20% for LTCG and slab rates for STCG. However, further distribution of such gains by the REIT to the unit holder is proposed to be exempt from tax liability. Analysis

In line with the commitment of the government to have housing for all by 2022, and also to promote the Prime Minister’s vision of ‘one hundred Smart Cities’, the Finance Minister in the Budget has proposed key reforms for foreign investment in the real estate and development sector. 1. Relaxation in minimum area and minimum capitalization The Finance Minister has proposed to reduce the requirement of minimum project size from 50,000 square metres to 20,000 square metres, and the capitalization requirement (for a wholly owned subsidiary) from USD 10 million to USD 5 million respectively. Analysis

2. Promoting affordable housing The Budget has proposed introduction of schemes to incentivize the development of low cost housing and has also allocated this year a sum of INR 40 billion for National Housing Bank for this purpose. In addition to the above relaxation, to further encourage this segment, projects which commit at least 30% of the total project cost for low cost affordable housing have been proposed to be exempted from minimum built-up area and capitalisation requirements under FDI. The Finance Minister has also proposed to include slum development in the statutory list of corporate social responsibility (“CSR”) activities. Analysis

REITs are beneficial not only for the sponsors but also the investors. It provides the sponsor (usually a developer or a private equity fund) an exit opportunity thus giving liquidity and enable them to invest in other projects. At the same time, it provides the investors with an avenue to invest in rental income generating properties in which they would have otherwise not been able to invest, and which is less risky compared to under-construction properties. For a REIT regime to be effectively implemented, complete tax pass through is essential, as is the case in most countries having effective REIT regimes. Though the tax incentives for REITs introduced in the Budget is definitively a positive move, however, the tax incentives only result in partial tax pass through to REIT, at the maximum. It is hoped that the Finance Minister would address the issues as mentioned in this piece going forward and possibly simplify the REIT taxation regime. Before REITs actually takes off, few other changes need to be introduced, especially from securities and exchange control laws perspective. Currently, units of a REIT may not even qualify as a 'security'. Since, units of a REIT have to be mandatorily listed, the first step will be to define units of a REIT as a security under the SCRA. The next step will be to amend exchange control regulations to allow foreign investments in units of a REIT. Capital account transaction rules will also need to be amended to exclude REITs from the definition of 'real estate business', as any form of foreign investment is currently not permitted in real estate business. Under current exchange control laws, investment in yield generating assets may qualify as 'real estate business'. The relaxations proposed in the Budget pertaining to affordable housing is a really positive move as there is a major demand for housing in this segment. All in all, the Budget represents the new government’s positive attitude and willingness to follow through on its message of growth and development, especially in the real estate sector. – Prasad Subramanyan, Deepak Jodhani & Ruchir Sinha You can direct your queries or comments to the authors 1 This provision would be effective only as of 1 October, 2014. DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

Budget 2014-15 (“Budget”) has introduced tax incentives for the real estate investment trusts (“REITs”) regime, and also provided for relaxations in foreign direct investment (“FDI”) regime. With the tax incentives in place, the Securities and Exchange Board of India (“SEBI”) is likely to formally announce the REIT regulations that are currently in draft form. In this hotline, we discuss some of the key changes and its Budget 2014 impact on the real estate sector. For a detailed analysis of the impact of Budget 2014-15 on other aspects as well, please refer to our hotline “India Budget 2014: New Beginnings and New Direction”.

CHANGES IN RELATION TO REITS1. Background

As a background, the Securities and Exchange Board of India (“SEBI”) had released the draft regulations on REITs (“Draft Regulations”) for comments on October 10, 2013. The Draft Regulations as released are available here. Though the Draft Regulations were received positively, it was imperative that attendant tax and regulatory incentives were also announced. Now, with the tax incentives announced and effective from October 1, 2014, it seems almost certain that the SEBI will put in place an operating framework for REITs by October 2014. Please refer to our article titled “REIT Regime In India: Draft REIT Regulations Introduced” for a detailed analysis of, and our suggestions on, the Draft Regulations.

2. Structure of REIT

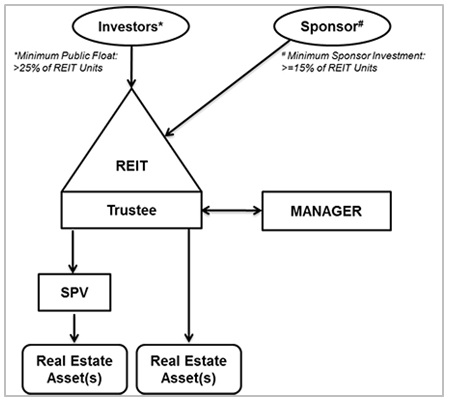

Before we move on the tax incentives proposed in the Budget, we set out below a quick snapshot of the REIT structure as contemplated under the Draft Regulations. REITs in India are required to be set up as private trusts under the purview of the Indian Trusts Act, 1882.

(i) Parties: The parties in the REIT include the sponsor, the manager, the trustee, the principal valuer and the investors / unit holders. Sponsor sets up the REIT, which is managed by the manager. The trustee holds the property in its name on behalf of the investors. The roles, responsibilities, minimum eligibility criteria and qualification requirements for each of the abovementioned parties are detailed in the Draft Regulations. Sponsors are required to hold a minimum of 15% (25% for the first 3 years) of the total outstanding units of the REIT at all times to demonstrate skin-in-the-game.

(ii) Use of SPV: REITs may hold assets directly or through an SPV. All entities in which REITs control majority interest qualify as an SPV for the purpose of the Draft Regulations.

(iii) Investment and Listing: Units of a REIT are compulsorily required to be listed on a recognized stock exchange.

(iv) Potential income streams: REITs are principally expected to invest in completed assets. Income would consist of rental income, interest income or capital gains arising from sale of real assets / shares of SPV.

(v) Distribution: 90% of net distributable income after tax of the REIT is required to be distributed to unit holders within 15 days of declaration.

The illustration below gives the typical REIT structure:

3. Proposed tax regime under the Budget

The Finance Bill, 2014 (“Bill”) proposes to amend the Income Tax Act (“ITA”) to provide for the income tax treatment of REITs. These provisions have been incorporated depending on the stream of income that the REIT is earning and distributing:

(i) Units of REIT akin to listed shares

The Bill proposes that when a unit holder disposes off units of a REIT, long term capital gains (“LTCG”) (units held for more than 36 months) would be exempt from tax and short term capital gains (“STCG”) would be taxed at 15% since units would be treated as listed securities under the ITA. In addition to the above, the Bill has also proposed that securities transaction tax is to be payable on transfer of units of a REIT.

Analysis

- Treatment of listed REITs unit akin to listed shares with respect to rates for LTCG and STCG is a major relaxation for the unit holders, and will give a major impetus to the REIT regime. Though the requirement of holding the units for at least 36 months for characterization as long term capital gains, unlike 12 months in case of listed shares, is understandable since REITs are meant to be akin to holding real estate directly which is any ways subject to 36 months holding period, this may be a disincentive to invest in REITs.

(ii) Tax treatment of the sponsor - The Bill proposes to make the transfer of shares of the SPV into a REIT in exchange for issue of units of the REIT to the transferor (or the sponsor) exempt from capital gains tax under the ITA. However, although the units of a REIT would be listed on a recognized stock exchange, specific amendments are proposed to exclude units of REITs from the exemption of tax on LTCG / STCG if sold by the sponsor; and the cost of acquisition of the shares of the SPV by the sponsor shall be deemed to be the cost of acquisition of the units of the REIT in his hands.

Analysis

- Although the Draft Regulations allow REITs to hold real estate assets either directly or through an SPV, the tax benefit for a sponsor to set up a REIT has been extended only to cases where real estate assets are held by the REIT through an SPV. This can be a substantial dampener for sponsors looking to set up REITs holding direct assets since transfer of real estate assets instead of an SPV to a REIT may involve a tax leakage.

- An additional issue that is outstanding is in cases where assets are held in a partnership or a limited liability partnership and on the tax treatment in order to transfer the partnership interest to the REIT.

(iii) Income in the nature of interest - The Bill provides for a pass through treatment in respect of any interest income that is received by the REIT from an SPV. This will result in the REIT not being subject to any tax in respect of such interest income, whereas the investors will be subject to tax on the same. However, there would be a levy of withholding tax that would be imposed on distribution by the REIT to its unit holder. This withholding tax would be at the rate of 10% if paid to resident unit holders and 5% if paid to non-resident unit holders.1 In case of non-resident unit holders, the 5% tax would be the final tax payable by the non-resident, while in case of residents, they will be subject to tax as per the tax rate applicable to them.

Analysis

- To avail the tax pass through on interest income, the sponsor would have to trade-off by paying tax on transfer of the SPV / assets. This is so because, (a) the REIT cannot acquire any debt securities without a tax incidence for the sponsor (the exemption is only for shares); and (b) if the monies are raised by REIT from the public, and infused into a newly created SPV by way of debt, which acquires the asset from the sponsor, there is no tax exemption for the sponsor in such case. To that extent, the benefit of this relaxation is highly questionable.

(iv) Income in the nature of dividend - Where dividends are distributed by the SPV to the REIT, the existing provision dealing with Dividend Distribution Tax (“DDT”) under Section 115-O of the ITA would apply and the SPV would face a 15% tax on distribution with no further liability on the REIT as a shareholder. Further, the Bill proposes that any income distributed by the REIT to its unit holder that is not in the nature of interest or capital gains is exempt from income tax. Therefore, distributions of dividends received from the SPV by the REIT to the unit holders would be exempt from tax in India.

Analysis

- Though distribution of monies received by the REIT as dividend to the until holders is exempt from tax in the hands of the unit holders, still the applicability of both, the corporate tax and dividend distribution tax, in the hands of SPV makes this route of distribution tax inefficient. Since, unlike listed developers, REITs are mandatorily required to distribute 90% of net distributable income after tax to investors, the applicability of dividend distribution tax is a major dampner. To ensure real pass through, it would have been better if the government had dispensed with the dividend distribution tax in case of REITs.

(v) Income in the nature of business profits/lease rentals/management fee - Chapter XII-FA is proposed to be added to the ITA by which Section 115UA is to be included for dealing with the taxation of income earned by a REIT that is not in the nature of capital gains, interest income or dividend. All such income is proposed to be taxed in the hands of the REIT at the maximum marginal rate i.e. 30%. Such income, while distributed by the REIT to the unit holders would be exempt in the hands of the unit holders.

Analysis

- This would apply in a situation where the REIT is holding the assets directly or in situations where they are charging fees to the SPV. There is no relaxation in such case, as even under the existing tax regime, tax once paid by a trust would have been exempt in the hands of the unit holders. To ensure true pass through to REIT, the gains should have been tax exempt in the hands of REIT and should have rather been taxed in the hands of the unit holders.

(vi) Income in the nature of capital gains - Where the REIT earns income by way of capital gains by sale of shares of the SPV, the REIT would be taxed as per regular rates for capital gains i.e. 20% for LTCG and slab rates for STCG. However, further distribution of such gains by the REIT to the unit holder is proposed to be exempt from tax liability.

Analysis

- Please refer to our analysis in point (v) above.

In line with the commitment of the government to have housing for all by 2022, and also to promote the Prime Minister’s vision of ‘one hundred Smart Cities’, the Finance Minister in the Budget has proposed key reforms for foreign investment in the real estate and development sector.

1. Relaxation in minimum area and minimum capitalization

The Finance Minister has proposed to reduce the requirement of minimum project size from 50,000 square metres to 20,000 square metres, and the capitalization requirement (for a wholly owned subsidiary) from USD 10 million to USD 5 million respectively.

Analysis

- Previously, in order to qualify for FDI, the project size had to be a minimum of 50,000 square metres and at least USD 10 million had to be infused for a wholly owned subsidiary. This was a major challenge since in Tier I cities which formed a bulk of the demand demography, finding such a large project was difficult, whereas in Tier II and III cities where such projects were available, the demand was not sufficient enough to warrant investor interest. This relaxation has partially addressed the long standing demand of the industry, which was expecting a reduction to 10,000 square metres, since even 20,000 square metres could be difficult for some Tier I cities (ex –Mumbai).

- The relaxation is a positive step towards providing impetus to development of smart cities providing habitation for the neo-middle class, as contemplated in the Budget.

2. Promoting affordable housing

The Budget has proposed introduction of schemes to incentivize the development of low cost housing and has also allocated this year a sum of INR 40 billion for National Housing Bank for this purpose. In addition to the above relaxation, to further encourage this segment, projects which commit at least 30% of the total project cost for low cost affordable housing have been proposed to be exempted from minimum built-up area and capitalisation requirements under FDI. The Finance Minister has also proposed to include slum development in the statutory list of corporate social responsibility (“CSR”) activities.

Analysis

- The INR 40 billion allocated for NHB will increase the flow of cheaper credit for affordable housing to the urban poor and lower income segment. Further, the relaxation of 20,000 square metres requirements in case of projects committing at least 30% project cost to low cost affordable housing, would provide a major fillip to affordable housing projects where the size of the project is less than 20,000 square metres.

- A critical element however will be the way ‘affordable housing’ is defined. The Budget does not lay down the criteria for classification of affordable housing. Under external commercial borrowing regulations, the criteria for affordable housing includes units having maximum carpet area of 60 square metres, and cost of such individual units not exceeding INR 30 lakh.

- The Companies Act, 2013 has introduced CSR provisions which are applicable to companies with an annual turnover of INR 10 billion and more, or a net worth of INR 5 billion and more, or a net profit of INR 0.05 billion or more during any financial year. Companies that trigger any of the aforesaid conditions are required to spend least two per cent (2%) of their average net profits made during the three immediately preceding financial years on CSR activities and/or report the reason for spending or non-expenditure. The proposition of the Finance Minister to include slum development in the statutory list of corporate social responsibility activities is quite encouraging, as it not only provides developers an avenue to meet their CSR requirements, but also at the same time could give a huge impetus to this segment.

REITs are beneficial not only for the sponsors but also the investors. It provides the sponsor (usually a developer or a private equity fund) an exit opportunity thus giving liquidity and enable them to invest in other projects. At the same time, it provides the investors with an avenue to invest in rental income generating properties in which they would have otherwise not been able to invest, and which is less risky compared to under-construction properties.

For a REIT regime to be effectively implemented, complete tax pass through is essential, as is the case in most countries having effective REIT regimes. Though the tax incentives for REITs introduced in the Budget is definitively a positive move, however, the tax incentives only result in partial tax pass through to REIT, at the maximum. It is hoped that the Finance Minister would address the issues as mentioned in this piece going forward and possibly simplify the REIT taxation regime.

Before REITs actually takes off, few other changes need to be introduced, especially from securities and exchange control laws perspective. Currently, units of a REIT may not even qualify as a 'security'. Since, units of a REIT have to be mandatorily listed, the first step will be to define units of a REIT as a security under the SCRA. The next step will be to amend exchange control regulations to allow foreign investments in units of a REIT. Capital account transaction rules will also need to be amended to exclude REITs from the definition of 'real estate business', as any form of foreign investment is currently not permitted in real estate business. Under current exchange control laws, investment in yield generating assets may qualify as 'real estate business'.

The relaxations proposed in the Budget pertaining to affordable housing is a really positive move as there is a major demand for housing in this segment. All in all, the Budget represents the new government’s positive attitude and willingness to follow through on its message of growth and development, especially in the real estate sector.

– Prasad Subramanyan, Deepak Jodhani & Ruchir Sinha

You can direct your queries or comments to the authors

1 This provision would be effective only as of 1 October, 2014.

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersCompendium of Research Papers Decoding Downstream Investment Mergers & Acquisitions |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |