GIFT City ExpressSeptember 12, 2023 Family Offices in GIFT City – What are they and how do they actually work?INTRODUCTIONWith news articles coming out nearly every week, and IFSCA issuing relaxations to enable funding from a larger set of investors, the buzz around family offices in GIFT City has only been getting louder. However, there are a few practical issues that require further discussion. This article briefly sets out the current framework governing family office in GIFT City and highlights some practical considerations that may be relevant for high net-worth Indian families thinking about setting up their own family office in GIFT City. WHAT IS A FAMILY OFFICE AND CAN I SET ONE UP IN GIFT CITY?While family offices in India have only started gaining traction in the last few years, family offices as a concept is not new. In fact, in Europe the concept originated in the sixth century with royalty using stewards to help manage their wealth and family affairs. In the US, high net worth families have been using these structures since the early 1800s. In modern times, a family office in these jurisdictions are generally treated as a one-stop shop for all the family’s needs. They manage everything from the family’s estate planning to health care and education related requirements, with investment activities being just one part of a larger portfolio of services offered to the family. In India, the landscape is a little different. While some large family offices may provide a more comprehensive portfolio of services, generally family offices are thought of as the investment arm or wealth management entity for the family. It is in this limited context that IFSCA has issued its framework for Family Investment Funds (“FIF”), whereby FIFs can only act as investment vehicles for the family and are not intended to be used to meet the family’s succession planning or other requirements. A LIGHT-TOUCH FRAMEWORKIFSCA introduced the framework for Family Investment Funds (“FIFs”) under the IFSCA (Fund Management) Regulations, 2022 (“FM Regulations”). While the FM Regulations provide detailed conditions for fund managers and the funds they launch, a light-touch approach has been afforded to FIFs. Self-managed Pooling Vehicle For example, a typical private equity fund in GIFT City is required to be managed by a separate fund manager. This means that two entities are required to be set up, one to act as the fund manager and register as a Fund Management Entity (“FME”) with IFSCA under the FM Regulations, and another to act as the pooling vehicle (ie. the fund). However, as per the FM Regulations, FIFs are self-managed pooling vehicles. Accordingly, only one entity is required to be set up, and this entity obtains registration as an Authorised FME under the FM Regulations as well as acts as the pooling vehicle for the family. The ability to structure an FIF using just one entity is a simple, but valuable facility which helps significantly reduce cost and compliance burden for the family. Moreover, while other Authorised FMEs must be set up as either companies or LLPs (or a branch thereof), FIFs may also be set up contributory trusts. If the FIF is set up as a contributory trust, the investors in the FIF must also be beneficiaries of the trust. Further, such beneficiaries and their beneficial interest must be fixed and identifiable in the Trust Deed at all times. The ability to set up the FIF as a trust allows families the flexibility to use a cost-effective structure, which is also tax efficient and subject to fewer regulatory compliances as compared to companies and LLPs. However, families intending to use a trust structure should keep in mind potential foreign exchange implications of appointing an Indian-resident trustee. Typically, any fund set up in the IFSC at GIFT City is treated as a non-resident for foreign exchange purposes and therefore investments made by these funds are not subject to the conditions prescribed under India’s foreign exchange regulations for overseas investment (“FEMA”). However, under the Trusts Act, 1882, it is the trustee, and not the trust (ie. the FIF) which is considered the legal and beneficial owner of all property held in the trust. Accordingly, RBI could take the view that as the assets held in the FIF are owned by an Indian-resident trustee, that all overseas investments should be subject to FEMA. Interestingly, this issue does not arise with respect to other funds structured as trusts in GIFT City because in all other cases, IFSCA mandates that only institutional trustees located in GIFT City can act as trustees to such funds. In such a scenario the trustee itself is also a non-resident by virtue of being incorporated in the IFSC, and accordingly foreign exchange conditions are not applicable. Pooling Funds from a Single Family Once set up, the FIF is only permitted to pool funds from a single family. While the original definition of ‘single family’ under the FM Regulations had been limited to a group of individuals all being lineal descendant of a common ancestor (and their spouses and children1); it was later expanded2 to also include entities such as sole proprietorship firms, partnership firms, companies, limited liability partnerships, trusts and body corporates, in which the family exercises control and directly or indirectly holds substantial economic interest.3 The decision to allow FIFs to raise funds from entities was instrumental for developing a workable fund-raising framework. Prior to this change, FIFs could only raise funds from individual family members who could remit a maximum of only USD 250,000 per year under the Liberalised Investment Scheme (“LRS”). However, while the revised definition of ‘single family’ now also includes trusts, Indian families should keep in mind that FEMA does not currently permit trusts to remit money overseas. Accordingly, families who currently house their wealth in domestic trust structures for succession planning purposes will need to consider alternative structures for remitting funds to their FIF in GIFT City. The FIF can also accept contributions from its employees, directors, or other persons providing services to the FIF, if: (i) the same is permitted under the FIF’s internal policy as a reward for providing services to the FIF; or (ii) the contribution is being taken in order to align the interests of such person with the interests of the FIF. However, such contribution should only be accepted for the limited purpose of granting economic interest and should not exceed (in aggregate) 20% of the FIF’s profits. The flexibility to allow employees and directors of a fund manager to contribute to a fund in order to participate in its profit share is market standard across both AIFs set up in India as well as funds set up abroad. However, considering that the FIF is intended to operate as a self-managed fund, where the management is likely to reside with individual family members who are anyway permitted to contribute to the FIF, it will be interesting to see whether families setting up FIF structures will take advantage of this added flexibility. Net-worth and Target Corpus Another aspect of IFSCA’s light-touch regime is that FIFs do not need to satisfy the net worth requirement (USD 75,000) applicable to other Authorised FMEs. Moreover, funds managed by Authorised FMEs typically have a minimum investor contribution of USD 250,000; however, no such minimum is prescribed for investors of an FIF. Instead, an FIF is required to have a minimum target corpus of USD 10 million (within the first three years of launch). Although the USD 10 million corpus can be built up over the first three years of the FIF’s launch, where family members are funding the FIF directly, each individual is subject to a cap of USD 250,000 under the LRS route. This may cause some difficulties for families who do not wish to bring multiple family members into the FIF structure as contributors. In such case, the family may consider using existing group companies / LLPs or setting up a new structure for funding the FIF - both options have a range of considerations to keep in mind. Permissible Investments The FM Regulations specifically allow FIFs to invest in a wide array of assets, including (but not limited to): a) Unlisted, listed or to-be listed securities b) Debt securities; c) Other investment schemes set up in the IFSC, India and foreign jurisdiction (including mutual funds and AIFS in India or abroad); d) Derivatives including commodity derivatives; e) Investment in LLPs; and f) Physical assets such as real estate, bullion, art, etc.; However, families should keep in mind that FIFs should only be used for undertaking overseas portfolio investments. Accordingly, while IFSCA may be comfortable with an FIF investing in physical assets, like real estate, art, etc. as a part of a larger portfolio which includes other asset types, an FIF set up only for investment into physical assets for self-use may not be permitted. Similarly, FIFs set up to fund overseas associates or group companies may not be permitted. Moreover, investment back into India through an FIF which is funded from India is not permissible. WHY GIFT AND NOT OVERSEAS?Investment by way of OPI Recent changes to India’s foreign exchange regulations have made it relatively more difficult for families to invest overseas. For example, under the new Foreign Exchange Management (Overseas Investment) Rules, 2022 (“OI Rules”), investment into unlisted securities can generally only be done through the Overseas Direct Investment (“ODI”) route. However, individuals are not permitted to make ODI in foreign entities engaged in financial services activities. As overseas family offices acting as pooling vehicles for making investments may be considered foreign entities engaged in financial services activities, individual family members should not be permitted to set up such family investment structures in overseas jurisdictions like Singapore by way of ODI. That being said, the Master Directions to the OI Rules, clarify that investment by Indian resident individuals (and listed entities) into overseas funds which are regulated by a financial services regulator of the host jurisdiction is permissible by way of Overseas Portfolio Investment (“OPI”). Accordingly, individuals (and listed entities) are permitted to make OPI in overseas funds which are regulated. However, most of the common jurisdictions for setting up family offices like Singapore and Delaware do not typically regulate funds, but only the fund managers. Moreover, unlisted entities are entirely prohibited from making OPI in overseas funds, whether regulated or not. The OI Rules provide a more favourable regime for remittance into GIFT City. Specifically, the OI Rules provide that any investment into pooling vehicles set up in GIFT City should be treated as OPI. This makes it possible for families to either individually, or through their listed or unlisted group entities, remit funds to an FIF in GIFT by way of OPI. The FIF can then freely make global investments without being subject to FEMA restrictions. Such OPI investment by individuals should be through the Liberalised Remittance Scheme (“LRS”) with a cap of USD 250,000 per individual per financial year, and a cap of 50% of net worth per financial year for listed and unlisted entities. A summary of permissible OPI into GIFT FIFs and overseas family offices is provided in the table below.

FIF TAXATIONUnlike other private equity funds set up under the FM Regulations, the taxation of an FIF is not governed under section 115UB of the Income-tax Act, 1961 (“ITA”), which grants pass through status to all qualifying funds regardless of legal form. Instead, an FIF’s taxation is determined by whether it is set up as a trust, LLP or company. For example, in the case of an FIF set up by an Indian resident family and investing entirely in offshore portfolio investments, if the FIF is set up as a fixed interest trust, contributions made to the trust by investor beneficiaries as well as distributions from the trust to its investor beneficiaries should be tax exempt. Capital gains earned by the FIF should be taxed in the hands of the trustee as a representative assessee of the investor beneficiaries in the same manner and to the same extent as such income would have been taxed in the hands of the relevant investor beneficiary. If the FIF is instead set up as an LLP, capital gains earned by the FIF should be taxable at the rate of 20% (plus applicable surcharge and cess); however, subsequent distributions to partners should be tax exempt. Accordingly, in both the trust and LLP structures there should be only one level of tax (ie. in the hands of the FIF itself, and not on further distribution to family members). By comparison, typically offshore family offices are also structured in jurisdictions which provide for only one layer of taxation – generally, at the time of distribution from the family office to the Indian family members (or their group companies). When such distribution is in the nature of dividends or short-term capital gains (where shares are held for less than 24 months) the income should be taxable at the relevant income slab rates of the individuals (or corporate tax rates for entities). Distributions in the form of long-term capital gains (where shares are held for 24 months or more) should be taxed at 20% (plus applicable surcharge and cess). CONCLUSIONIFSCA’s light-touch regulatory framework for FIFs, coupled with foreign exchange provisions which promote investment into IFSC funds and a tax regime comparable with popular offshore jurisdictions has made GIFT City into an appealing jurisdiction for Indian families who want access to global markets. However, considering the many nuances of both the FM Regulations as well as India’s foreign exchange regulations, it becomes critical to ensure that an appropriate structure is designed with respect to the FIF itself as well as how it will be funded from India. You can direct your queries or comments to the authors. 1The definition includes widows and widowers, whether remarried or not, and stepchildren, adopted children, ex nuptial children 2IFSCA Circular No. F. No. 333/IFSCA/FIF/2022-23 dated March 01, 2023. 3‘Substantial economic interest’ means at least 90% economic interest which may include (i) percentage of shareholding in a company with share capital; or right to exercise control in case of a company without share capital; (ii) percentage share of profits in case of partnership firm and limited liability partnership; (iii) percentage of beneficial interest specified in trust deed in case of a determinate trust; or pro-rata share in the trust property in case of an indeterminate trust. DisclaimerThe contents of this hotline should not be construed as legal opinion. View detailed disclaimer. |

|

INTRODUCTION

With news articles coming out nearly every week, and IFSCA issuing relaxations to enable funding from a larger set of investors, the buzz around family offices in GIFT City has only been getting louder. However, there are a few practical issues that require further discussion. This article briefly sets out the current framework governing family office in GIFT City and highlights some practical considerations that may be relevant for high net-worth Indian families thinking about setting up their own family office in GIFT City.

WHAT IS A FAMILY OFFICE AND CAN I SET ONE UP IN GIFT CITY?

While family offices in India have only started gaining traction in the last few years, family offices as a concept is not new. In fact, in Europe the concept originated in the sixth century with royalty using stewards to help manage their wealth and family affairs. In the US, high net worth families have been using these structures since the early 1800s. In modern times, a family office in these jurisdictions are generally treated as a one-stop shop for all the family’s needs. They manage everything from the family’s estate planning to health care and education related requirements, with investment activities being just one part of a larger portfolio of services offered to the family.

In India, the landscape is a little different. While some large family offices may provide a more comprehensive portfolio of services, generally family offices are thought of as the investment arm or wealth management entity for the family. It is in this limited context that IFSCA has issued its framework for Family Investment Funds (“FIF”), whereby FIFs can only act as investment vehicles for the family and are not intended to be used to meet the family’s succession planning or other requirements.

A LIGHT-TOUCH FRAMEWORK

IFSCA introduced the framework for Family Investment Funds (“FIFs”) under the IFSCA (Fund Management) Regulations, 2022 (“FM Regulations”). While the FM Regulations provide detailed conditions for fund managers and the funds they launch, a light-touch approach has been afforded to FIFs.

Self-managed Pooling Vehicle

For example, a typical private equity fund in GIFT City is required to be managed by a separate fund manager. This means that two entities are required to be set up, one to act as the fund manager and register as a Fund Management Entity (“FME”) with IFSCA under the FM Regulations, and another to act as the pooling vehicle (ie. the fund). However, as per the FM Regulations, FIFs are self-managed pooling vehicles. Accordingly, only one entity is required to be set up, and this entity obtains registration as an Authorised FME under the FM Regulations as well as acts as the pooling vehicle for the family. The ability to structure an FIF using just one entity is a simple, but valuable facility which helps significantly reduce cost and compliance burden for the family.

Moreover, while other Authorised FMEs must be set up as either companies or LLPs (or a branch thereof), FIFs may also be set up contributory trusts. If the FIF is set up as a contributory trust, the investors in the FIF must also be beneficiaries of the trust. Further, such beneficiaries and their beneficial interest must be fixed and identifiable in the Trust Deed at all times.

The ability to set up the FIF as a trust allows families the flexibility to use a cost-effective structure, which is also tax efficient and subject to fewer regulatory compliances as compared to companies and LLPs. However, families intending to use a trust structure should keep in mind potential foreign exchange implications of appointing an Indian-resident trustee. Typically, any fund set up in the IFSC at GIFT City is treated as a non-resident for foreign exchange purposes and therefore investments made by these funds are not subject to the conditions prescribed under India’s foreign exchange regulations for overseas investment (“FEMA”). However, under the Trusts Act, 1882, it is the trustee, and not the trust (ie. the FIF) which is considered the legal and beneficial owner of all property held in the trust. Accordingly, RBI could take the view that as the assets held in the FIF are owned by an Indian-resident trustee, that all overseas investments should be subject to FEMA. Interestingly, this issue does not arise with respect to other funds structured as trusts in GIFT City because in all other cases, IFSCA mandates that only institutional trustees located in GIFT City can act as trustees to such funds. In such a scenario the trustee itself is also a non-resident by virtue of being incorporated in the IFSC, and accordingly foreign exchange conditions are not applicable.

Pooling Funds from a Single Family

Once set up, the FIF is only permitted to pool funds from a single family. While the original definition of ‘single family’ under the FM Regulations had been limited to a group of individuals all being lineal descendant of a common ancestor (and their spouses and children1); it was later expanded2 to also include entities such as sole proprietorship firms, partnership firms, companies, limited liability partnerships, trusts and body corporates, in which the family exercises control and directly or indirectly holds substantial economic interest.3

The decision to allow FIFs to raise funds from entities was instrumental for developing a workable fund-raising framework. Prior to this change, FIFs could only raise funds from individual family members who could remit a maximum of only USD 250,000 per year under the Liberalised Investment Scheme (“LRS”). However, while the revised definition of ‘single family’ now also includes trusts, Indian families should keep in mind that FEMA does not currently permit trusts to remit money overseas. Accordingly, families who currently house their wealth in domestic trust structures for succession planning purposes will need to consider alternative structures for remitting funds to their FIF in GIFT City.

The FIF can also accept contributions from its employees, directors, or other persons providing services to the FIF, if: (i) the same is permitted under the FIF’s internal policy as a reward for providing services to the FIF; or (ii) the contribution is being taken in order to align the interests of such person with the interests of the FIF. However, such contribution should only be accepted for the limited purpose of granting economic interest and should not exceed (in aggregate) 20% of the FIF’s profits.

The flexibility to allow employees and directors of a fund manager to contribute to a fund in order to participate in its profit share is market standard across both AIFs set up in India as well as funds set up abroad. However, considering that the FIF is intended to operate as a self-managed fund, where the management is likely to reside with individual family members who are anyway permitted to contribute to the FIF, it will be interesting to see whether families setting up FIF structures will take advantage of this added flexibility.

Net-worth and Target Corpus

Another aspect of IFSCA’s light-touch regime is that FIFs do not need to satisfy the net worth requirement (USD 75,000) applicable to other Authorised FMEs. Moreover, funds managed by Authorised FMEs typically have a minimum investor contribution of USD 250,000; however, no such minimum is prescribed for investors of an FIF. Instead, an FIF is required to have a minimum target corpus of USD 10 million (within the first three years of launch).

Although the USD 10 million corpus can be built up over the first three years of the FIF’s launch, where family members are funding the FIF directly, each individual is subject to a cap of USD 250,000 under the LRS route. This may cause some difficulties for families who do not wish to bring multiple family members into the FIF structure as contributors. In such case, the family may consider using existing group companies / LLPs or setting up a new structure for funding the FIF - both options have a range of considerations to keep in mind.

Permissible Investments

The FM Regulations specifically allow FIFs to invest in a wide array of assets, including (but not limited to):

a) Unlisted, listed or to-be listed securities

b) Debt securities;

c) Other investment schemes set up in the IFSC, India and foreign jurisdiction (including mutual funds and AIFS in India or abroad);

d) Derivatives including commodity derivatives;

e) Investment in LLPs; and

f) Physical assets such as real estate, bullion, art, etc.;

However, families should keep in mind that FIFs should only be used for undertaking overseas portfolio investments. Accordingly, while IFSCA may be comfortable with an FIF investing in physical assets, like real estate, art, etc. as a part of a larger portfolio which includes other asset types, an FIF set up only for investment into physical assets for self-use may not be permitted. Similarly, FIFs set up to fund overseas associates or group companies may not be permitted. Moreover, investment back into India through an FIF which is funded from India is not permissible.

WHY GIFT AND NOT OVERSEAS?

Investment by way of OPI

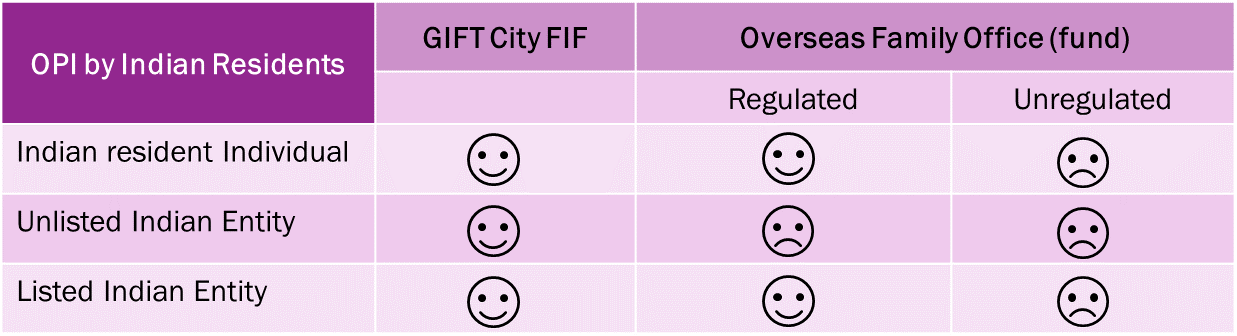

Recent changes to India’s foreign exchange regulations have made it relatively more difficult for families to invest overseas. For example, under the new Foreign Exchange Management (Overseas Investment) Rules, 2022 (“OI Rules”), investment into unlisted securities can generally only be done through the Overseas Direct Investment (“ODI”) route. However, individuals are not permitted to make ODI in foreign entities engaged in financial services activities. As overseas family offices acting as pooling vehicles for making investments may be considered foreign entities engaged in financial services activities, individual family members should not be permitted to set up such family investment structures in overseas jurisdictions like Singapore by way of ODI. That being said, the Master Directions to the OI Rules, clarify that investment by Indian resident individuals (and listed entities) into overseas funds which are regulated by a financial services regulator of the host jurisdiction is permissible by way of Overseas Portfolio Investment (“OPI”).

Accordingly, individuals (and listed entities) are permitted to make OPI in overseas funds which are regulated. However, most of the common jurisdictions for setting up family offices like Singapore and Delaware do not typically regulate funds, but only the fund managers. Moreover, unlisted entities are entirely prohibited from making OPI in overseas funds, whether regulated or not.

The OI Rules provide a more favourable regime for remittance into GIFT City. Specifically, the OI Rules provide that any investment into pooling vehicles set up in GIFT City should be treated as OPI. This makes it possible for families to either individually, or through their listed or unlisted group entities, remit funds to an FIF in GIFT by way of OPI. The FIF can then freely make global investments without being subject to FEMA restrictions. Such OPI investment by individuals should be through the Liberalised Remittance Scheme (“LRS”) with a cap of USD 250,000 per individual per financial year, and a cap of 50% of net worth per financial year for listed and unlisted entities.

A summary of permissible OPI into GIFT FIFs and overseas family offices is provided in the table below.

FIF TAXATION

Unlike other private equity funds set up under the FM Regulations, the taxation of an FIF is not governed under section 115UB of the Income-tax Act, 1961 (“ITA”), which grants pass through status to all qualifying funds regardless of legal form. Instead, an FIF’s taxation is determined by whether it is set up as a trust, LLP or company. For example, in the case of an FIF set up by an Indian resident family and investing entirely in offshore portfolio investments, if the FIF is set up as a fixed interest trust, contributions made to the trust by investor beneficiaries as well as distributions from the trust to its investor beneficiaries should be tax exempt. Capital gains earned by the FIF should be taxed in the hands of the trustee as a representative assessee of the investor beneficiaries in the same manner and to the same extent as such income would have been taxed in the hands of the relevant investor beneficiary. If the FIF is instead set up as an LLP, capital gains earned by the FIF should be taxable at the rate of 20% (plus applicable surcharge and cess); however, subsequent distributions to partners should be tax exempt. Accordingly, in both the trust and LLP structures there should be only one level of tax (ie. in the hands of the FIF itself, and not on further distribution to family members).

By comparison, typically offshore family offices are also structured in jurisdictions which provide for only one layer of taxation – generally, at the time of distribution from the family office to the Indian family members (or their group companies). When such distribution is in the nature of dividends or short-term capital gains (where shares are held for less than 24 months) the income should be taxable at the relevant income slab rates of the individuals (or corporate tax rates for entities). Distributions in the form of long-term capital gains (where shares are held for 24 months or more) should be taxed at 20% (plus applicable surcharge and cess).

CONCLUSION

IFSCA’s light-touch regulatory framework for FIFs, coupled with foreign exchange provisions which promote investment into IFSC funds and a tax regime comparable with popular offshore jurisdictions has made GIFT City into an appealing jurisdiction for Indian families who want access to global markets. However, considering the many nuances of both the FM Regulations as well as India’s foreign exchange regulations, it becomes critical to ensure that an appropriate structure is designed with respect to the FIF itself as well as how it will be funded from India.

You can direct your queries or comments to the authors.

1The definition includes widows and widowers, whether remarried or not, and stepchildren, adopted children, ex nuptial children

2IFSCA Circular No. F. No. 333/IFSCA/FIF/2022-23 dated March 01, 2023.

3‘Substantial economic interest’ means at least 90% economic interest which may include (i) percentage of shareholding in a company with share capital; or right to exercise control in case of a company without share capital; (ii) percentage share of profits in case of partnership firm and limited liability partnership;

(iii) percentage of beneficial interest specified in trust deed in case of a determinate trust; or pro-rata share in the trust property in case of an indeterminate trust.

Disclaimer

The contents of this hotline should not be construed as legal opinion. View detailed disclaimer.

Research PapersDecoding Downstream Investment Mergers & Acquisitions New Age of Franchising |

Research Articles |

AudioCCI’s Deal Value Test Securities Market Regulator’s Continued Quest Against “Unfiltered” Financial Advice Digital Lending - Part 1 - What's New with NBFC P2Ps |

NDA ConnectConnect with us at events, |

NDA Hotline |